Business Insurance in and around Saint Louis

Researching coverage for your business? Search no further than State Farm agent Ian Minnigerode!

No funny business here

- St. Louis County

- St. Charles County

- City of St. Louis

- Warren County

- Franklin County

- Lincoln County

- Jefferson County

- Kirkwood

- Sunset Hills

- Chesterfield

- Ballwin

- Fenton

- Clayton

- Manchester

- Wildwood

- Creve Coeur

- Brentwood

- Maplewood

- Webster Groves

- Ladue

- Arnold

- Crestwood

- Affton

- Ellisville

State Farm Understands Small Businesses.

Do you own a home cleaning service, a sporting good store or a music school? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Researching coverage for your business? Search no further than State Farm agent Ian Minnigerode!

No funny business here

Cover Your Business Assets

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Ian Minnigerode. With an agent like Ian Minnigerode, your coverage can include great options, such as commercial liability umbrella policies, artisan and service contractors and commercial auto.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Ian Minnigerode's team to discuss the options specifically available to you!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

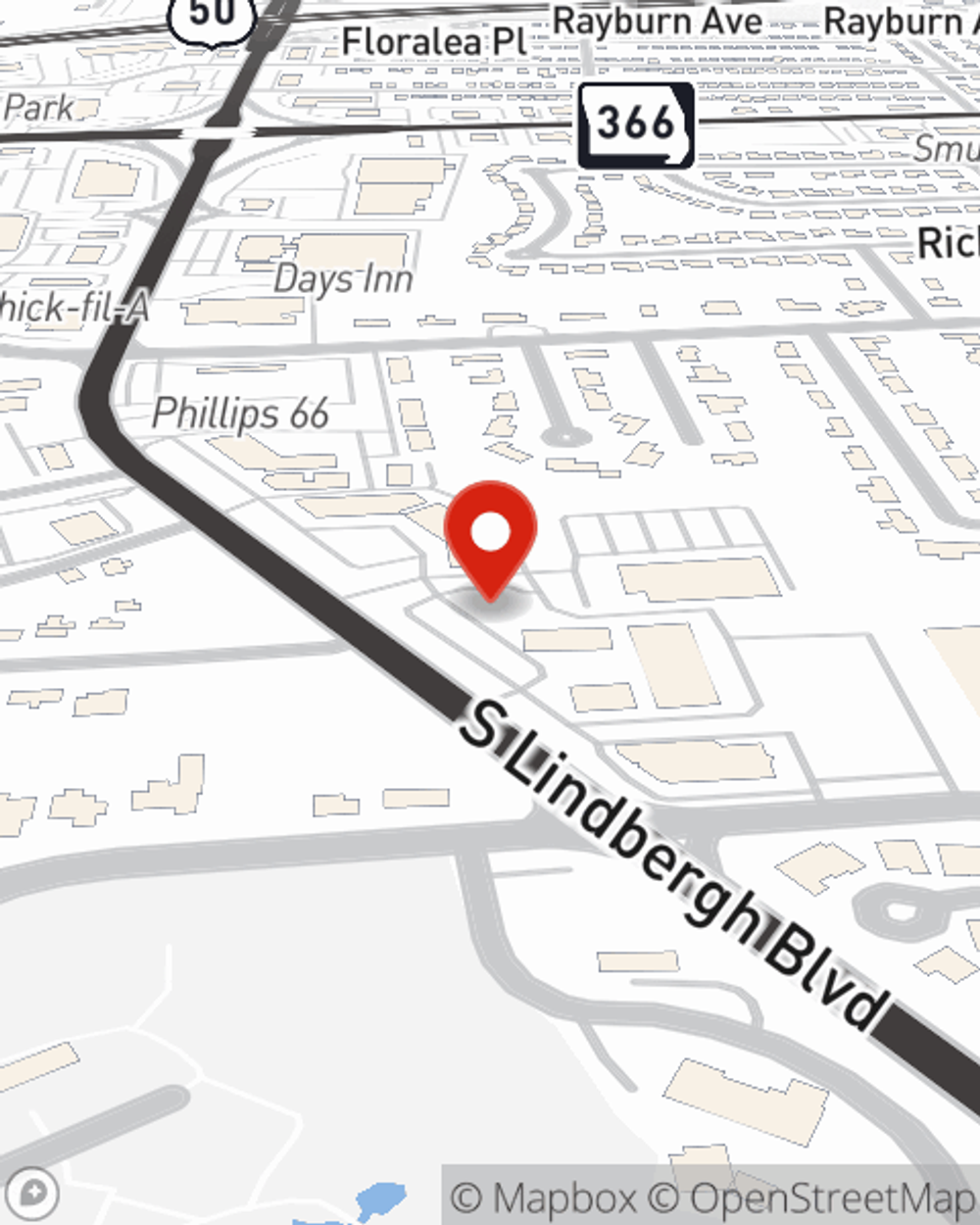

Ian Minnigerode

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.