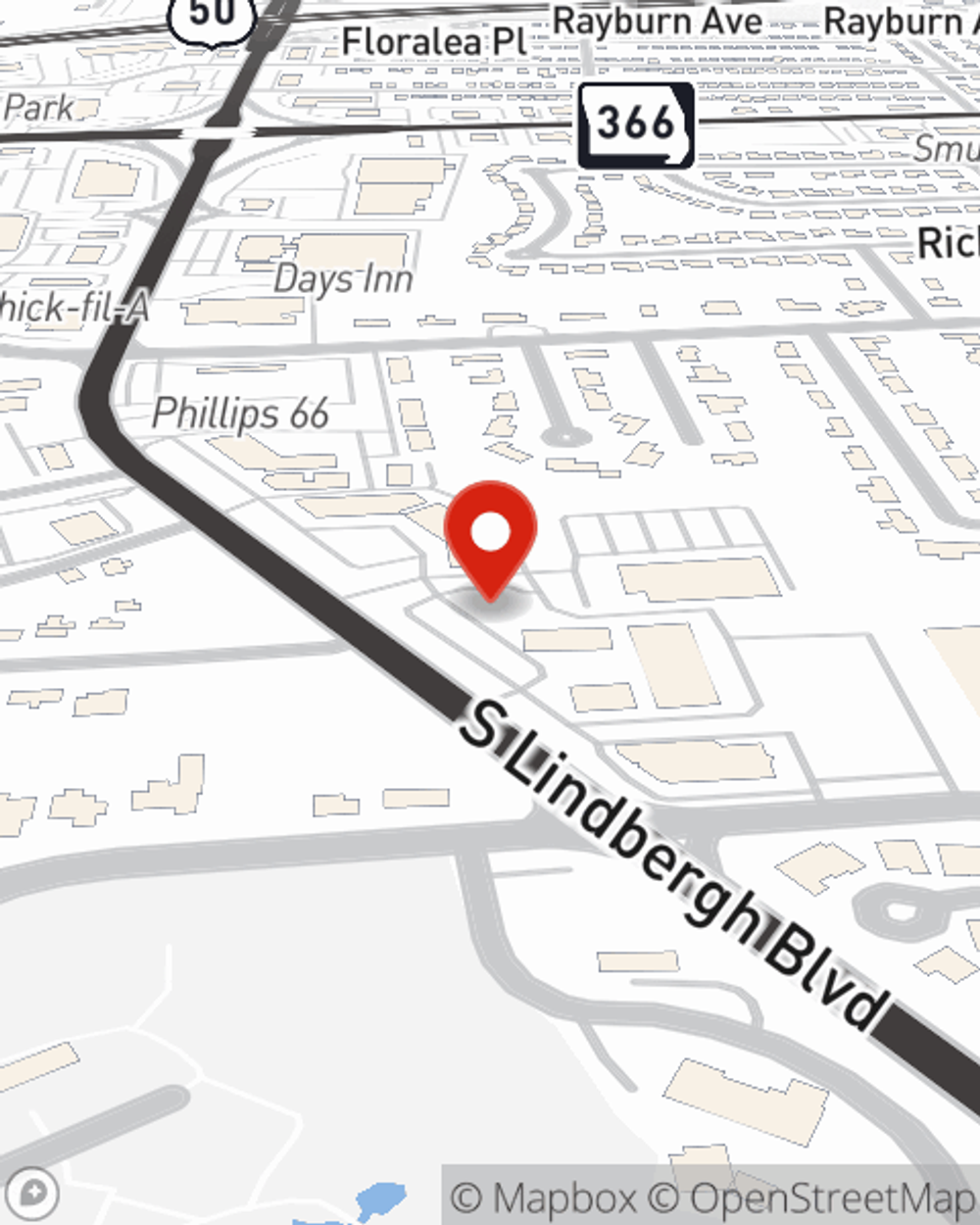

Life Insurance in and around Saint Louis

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- St. Louis County

- St. Charles County

- City of St. Louis

- Warren County

- Franklin County

- Lincoln County

- Jefferson County

- Kirkwood

- Sunset Hills

- Chesterfield

- Ballwin

- Fenton

- Clayton

- Manchester

- Wildwood

- Creve Coeur

- Brentwood

- Maplewood

- Webster Groves

- Ladue

- Arnold

- Crestwood

- Affton

- Ellisville

State Farm Offers Life Insurance Options, Too

The standard cost of funerals nowadays is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your family to come up with that much money as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help the people you love pay for burial costs and not fall into debt.

Get insured for what matters to you

Life won't wait. Neither should you.

Wondering If You're Too Young For Life Insurance?

You’ll get that and more with State Farm life insurance. State Farm has fantastic coverage options to keep your family members safe with a policy that’s personalized to accommodate your specific needs. Fortunately you won’t have to figure that out on your own. With strong values and fantastic customer service, State Farm Agent Ian Minnigerode walks you through every step to develop a policy that covers your loved ones and everything you’ve planned for them.

Interested in discovering what State Farm can do for you? Get in touch with agent Ian Minnigerode today to get to know your specific Life insurance options.

Have More Questions About Life Insurance?

Call Ian at (314) 849-2188 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Ian Minnigerode

State Farm® Insurance AgentSimple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.